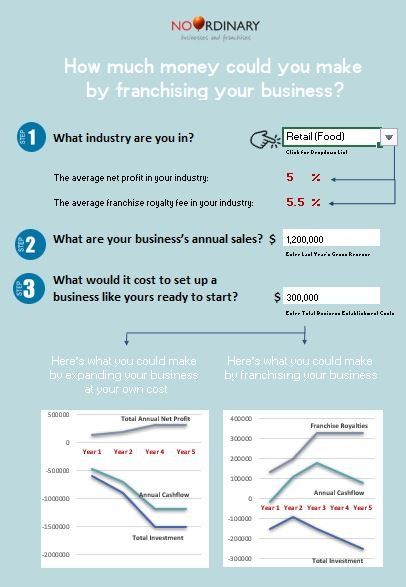

Here’s How Much You Could Make By Franchising Your Business

Download this FREE Business Expansion Modelling Tool and find out for yourself in just three steps.*

You’ll see in seconds how franchising compares to funding your business expansion yourself.

* The results produced by the Calculator are based on industry averages and are intended as an indicative guide only. Scroll down to find out how the Modelling Tool works. Every business is different so please don't hesitate to contact me

for a more specific assessment of your business's potential.

Franchising vs. Other Ways of Expanding Your Business

I have developed the Business Expansion Modelling Tool as a simple and practical way of understanding the difference between franchising your business and organic growth – that is, using your own resources and capital to fund expansion. Of course, there are pro’s and con’s of both methods. Over the last 60 years, franchising has become increasingly popular – but it’s not right for everyone. The purpose of the Business Expansion Modelling Tool is to help you understand if franchising is right for you.

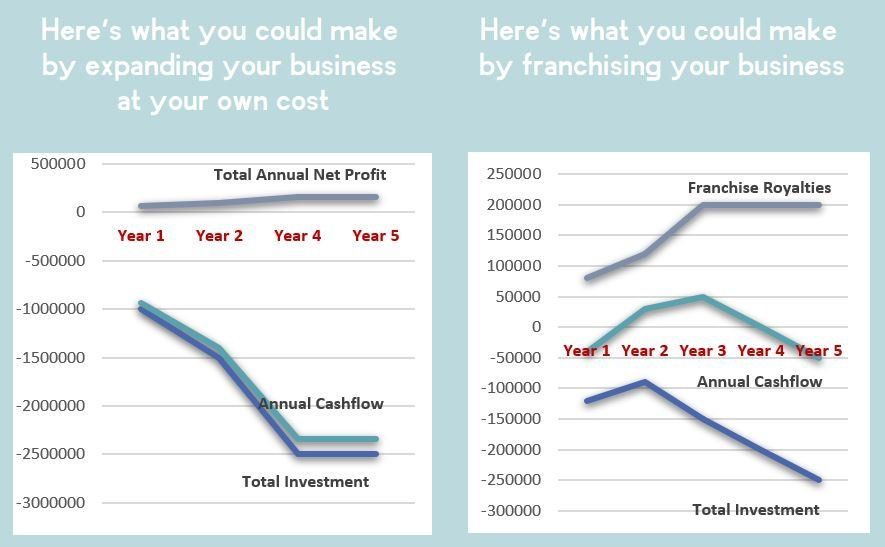

How to Optimise Growth Without Compromising Your Cashflow

Cash is king in business and one of the main causes of failure, even in fast-growing businesses, is running out of cash. The purpose of the Business Expansion Modelling Tool is to compare the typical cashflow of franchised vs. organically growing businesses over five years. Because franchising is self-funding, you're more likely to maintain positive cashflow, whereas funding your growth out of your own capital will push your cashflow into negative territory. (Of course, you could argue that you could borrow the money or get investors in. But that money is never really yours – you will need to pay the lenders back and the investors will expect a piece of your business in return.)

Cashflow Differences Visualised

To illustrate this, the Business Expansion Modelling Tool will automatically produce two graphs based on your industry selection in the dropdown list in Step 1 and the financial details you enter in Steps 2 and 3. The graph on the left estimates the cashflow for an organically-growing business over five years, using the average Net Profit for your industry combined with the figures you enter yourself in Step 2 (your business's annual revenue) and Step 3 (the cost to set up a business like yours). The graph on the right estimates the cashflow for a business which has been franchised, using the average Franchise Royalty Fee for your industry combined with the figures you enter in Steps 2 and 3. This gives you two different business expansion scenarios to compare.

Download Your Business Expansion Modelling Tool With My Compliments

I'm Robin La Pere, no ordinary business scaling and franchise consultant. My mission is to help business owners like you take your business to the next level. The first step is to decide on the best option for doing this – so I've put together this Business Expansion Modelling Tool to give you an instant comparison between two of the most popular options. Give it a try!

Contact Us

Of course, the Modelling Tool is no substitute for professional advice, so don't hesitate to contact me if you have any questions and would like to take advantage of a free Initial Consultation. I have many years' experience in working with business owners to take cost and risk out of successful scaling, whether that be by franchising or other means.

Think Franchising Could Be Right For You? Take the Next Step

Still can't decide if scaling up or franchising your business is for you? These two short quizzes will help. Click on the image to go to the quiz.

Or Get Started Now with a

Free Initial Consultation

Contact me to arrange a 30-minute Zoom or phone chat about

- Your vision for the future of your business

- How franchising could be the ideal way to scale your business

- How we can help you create a world-class franchise

I look forward to hearing from you!

Contact Us