What Does Trump’s Win Mean for Franchising Around the World?

Donald Trump hasn’t yet taken his place as the 47th president of the United States, but he is already starting to make his mark again on world politics and economies.

He has reportedly started making calls to other world leaders, warning Russia’s Putin not to escalate the Ukraine war and telling Ukraine’s Zelensky – with Elon Musk in the room, strangely enough – that he will continue to support Ukraine.

You may think that because the US has already had four years of Trump, the next four years won’t be much different from the first. But Trump is anything but predictable.

So what can we in the international franchise community expect over the next four years? Because we will certainly feel the impact of Trump’s policies, wherever we are in the world.

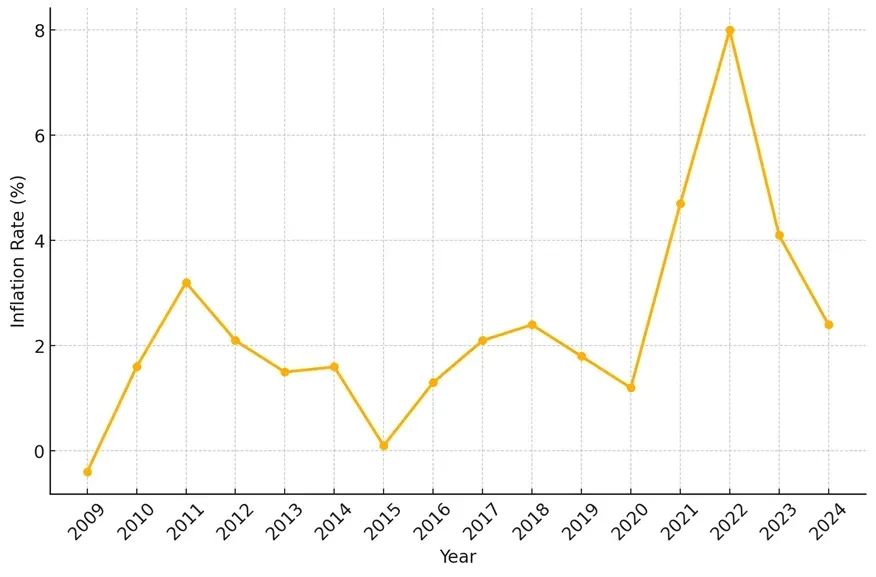

Trump built his campaign on beating inflation and the rising cost of living and doing business. Will that happen?

Of course, Trump’s new administration will benefit from the fact that the post-pandemic surge of inflation – caused primarily by the pandemic's disruption of the global supply chain and pandemic relief aid from the government rather than anything Biden could have done about it – is becoming a more distant memory anyway.

US Annual Inflation Rate 2009 - 2024

But while Trump’s policies are intended to bring inflation down further, many economists express concerns that they could have the opposite effect.

Source: What Donald Trump’s Win Means for Inflation. Time Magazine, 11 November 2024

Will Trump’s proposed tax cuts for individuals be good or bad for businesses inside and outside the United States?

Trump has promised tax cuts for individuals, just as he did in his first term as president. And the effects of the new round of cuts for businesses are likely to be similar to the last ones.

Positive Effects for Businesses

Increased Consumer Spending: Tax cuts boost disposable income, leading to higher consumer spending, which drives economic growth

Increased U.S. Imports: Higher US consumer spending can boost demand for imported goods, benefiting foreign businesses exporting to the US

Economic Stimulus: Enhanced spending can stimulate demand, encouraging businesses to expand and hire, potentially reducing unemployment rates

Currency Appreciation: Economic growth may strengthen the US dollar further, making US exports more expensive and imports cheaper, affecting international trade balances

Tax Policy Reforms in Other Countries: In response to the US tax cuts under the previous Trump administration, several countries have reevaluated their tax policies to remain competitive. This has led to tax reforms aimed at reducing corporate tax rates or offering incentives to retain and attract businesses. For instance, some European countries have adjusted their tax structures to prevent capital flight and maintain their appeal to multinational corporations.

Negative Effects for Businesses

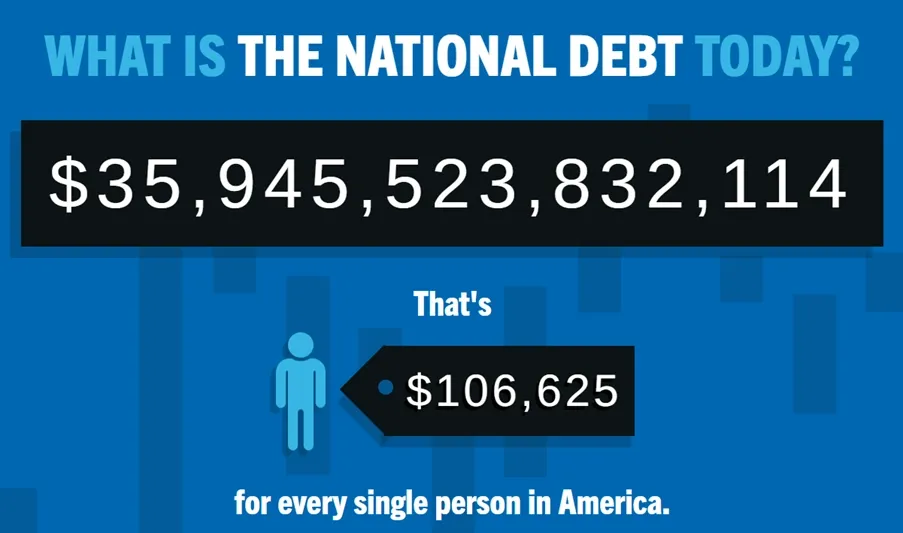

Budget Deficits: Reduced tax revenues can increase federal deficits, potentially leading to higher borrowing costs and interest rates. The US already owes a whopping $35 TRILLION and interest payments are reported to be at least $1 trillion per year.

Income Inequality: If tax cuts disproportionately benefit higher-income individuals, income inequality may widen, potentially dampening overall economic growth

Currency Appreciation: I’ve got this effect under both Positive and Negative because any further appreciation of the US dollar will impact US and foreign businesses disproportionately

Global Interest Rates: Increased US deficits can lead to higher global interest rates, raising borrowing costs for international businesses

How will lower US corporate tax rates affect businesses and franchises outside the United States?

Trump’s promise of cutting corporate tax is obviously good news for businesses in the US, but it puts more competitive pressure on foreign businesses, including franchises.

The Trump administration’s Tax Cuts and Jobs Act (TCJA) of 2017 lowered the US federal corporate tax rate from 35% to 21%, making the US a more attractive destination for business operations. This change has intensified competition for foreign franchises and businesses, as they now face a more favourable tax environment in the US.

Franchises and businesses outside the US now face added pressure to maintain competitiveness with US-based counterparts which may benefit from tax savings. Lower corporate taxes allow US franchises to reinvest savings into areas such as innovation, marketing or expansion, potentially creating a market advantage. Franchises based outside the US may need to find alternative ways to increase efficiencies or consider relocating operations to the US to remain competitive.

Interest rates have already started to come down. Will they come down further?

Interest expenses are a big part of the cost of doing business, especially for franchisees who have just bought in and are building their businesses.

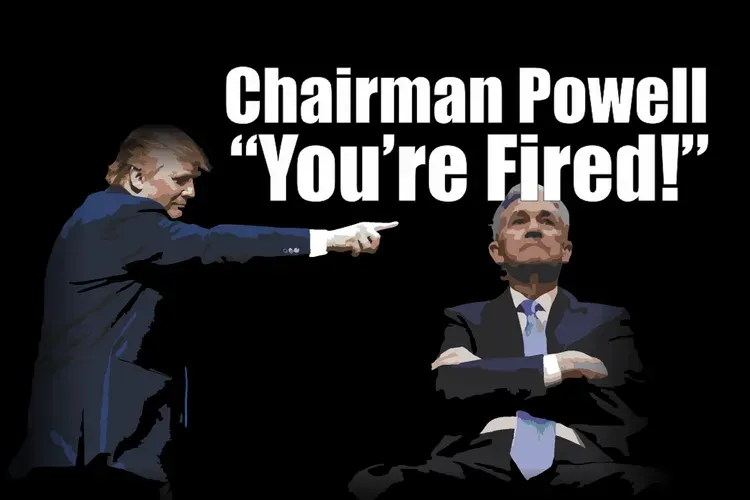

The US Federal Reserve cut its rate from a 20-year high in September and is widely expected to continue reducing it – if inflation continues to decline.

But an inflation flare-up could derail the rate-cutting plans. Trump’s solution? Threaten to fire the chair of the US Federal Reserve, Jerome Powell, and put the Fed under greater government control. Powell’s dismissal would breach long-standing norms of central bank independence. If successful, such a move could have a serious impact on democracy and the separation of powers, with consequences around the world.

Will Trump continue to deregulate business and franchising?

Almost certainly. As a businessman himself, Trump’s stance on business regulation has always centered on reducing restrictions to foster growth and profitability, particularly for small and medium-sized enterprises. For franchising, this could mean:

Easing of Compliance Requirements: Reduced regulatory oversight might lessen compliance costs, potentially lowering barriers for new franchisees in the United States and creating a more attractive environment for US franchisors to expand domestically and franchisors from other countries to enter the US franchise market.

Simplifying Labour Laws:

If Trump’s past record is anything to go by, his next administration will continue to support relaxed labour laws, providing more flexibility for franchisors and franchisees in managing employment costs - and potentially lower costs for foreign franchises to enter the US market.

The irony of Trump ‘working’ at McDonald’s as part of his presidential campaign was lost on many people who believed he was simply taking a dig at Kamala’s supposedly ‘fake’ claim that she had worked at McDonald’s as a teenager. They had either forgotten or overlooked that Trump’s former administration had suppressed a push by McDonald's workers to raise their wages. The administration also rejected the National Labour Relations Board (NLRB) attempt to bring McDonald's to the table as a joint employer of its franchisees' employees. I’m sure this would have caused franchisors around the world to breathe a collective sigh of relief at having escaped a new precedent for franchising.

Will Trump’s ‘America First’ policy and higher import tariffs win the war against the US’s trade deficit with China but hurt other countries’ exports?

Trump advocates for imposing high tariffs on imports, particularly from China, to encourage domestic manufacturing and reduce reliance on foreign goods. He suggests a universal baseline tariff of 10% on all imports, with higher rates for specific countries, particularly China.

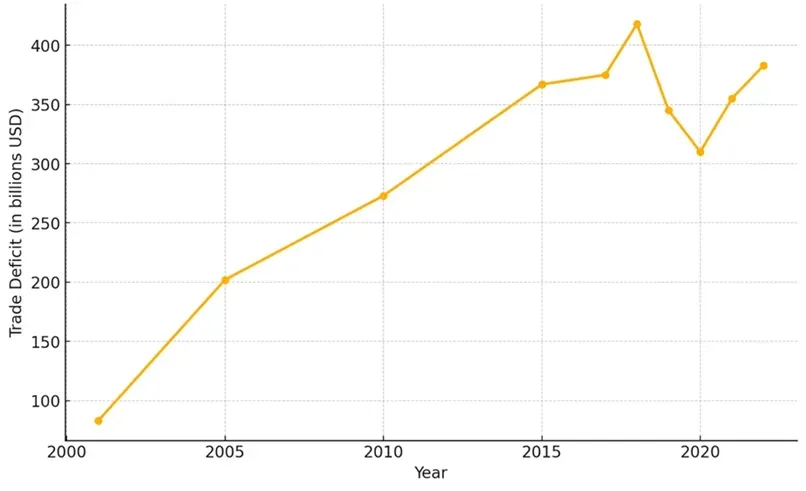

Why China? Trump – and the US in general – has always seen China as a political and economic threat. The higher tariffs he placed on Chinese imports during his last term in office may have had some impact on the enormous trade deficit the US has with China, but since the beginning of the pandemic the deficit has continued to grow.

US Trade Deficit With China 2001 - 2022

Trump claims that imposing higher tariffs will not raise prices for American consumers, but most economists and analysts beg to differ. They say that US businesses will need to pass the costs of these higher tariffs onto consumers. Analysts estimate that these tariffs could cost typical American households an additional $2,600 annually, according to the Associated Press.

Key Takeaways for Franchisors

Franchisors both inside and outside the United States will benefit from evaluating Trump’s policies and their potential impact on their businesses and franchisees. Proactive measures, such as adjusting supply chains, localising operations or reassessing international expansion plans, can help franchises stay resilient and seize opportunities within a changing global landscape.

As the new administration’s policies unfold, keeping an agile, adaptable approach will allow franchisors to stay competitive and leverage market shifts, potentially setting the stage for a new era in franchising worldwide.

Share on your Page:

Follow us: