The news media is abuzz – another recession is looming. Smart business people plan for these low points and implement strategies for long-term business success – no matter what the economy does. Have you?

The good news is, it may not be too late to prepare for the worst – provided you act now.

Our

10-Step Business Sur-thrive-al Programme

has been developed from lessons we learned from successfully navigating three previous recessions. We urge you to read this article, download our free ebook The U

ltimate Guide to Business Sur-thrival-al, and contact us for a free Initial Business Sur-thrive-al Consultation.

Before it's too late.

Step 1: Take a good hard look at your business

Often we’re so tied up in the day-to-day affairs of our business that we forget the importance of working on our business and not just in it. When was the last time you looked at your company from a strategic point of view? Do you have a Board of Directors or an Advisory Board to help you? If not, I can help you

set one up or provide you with objective, independent mentoring and support that takes the place of a Board.

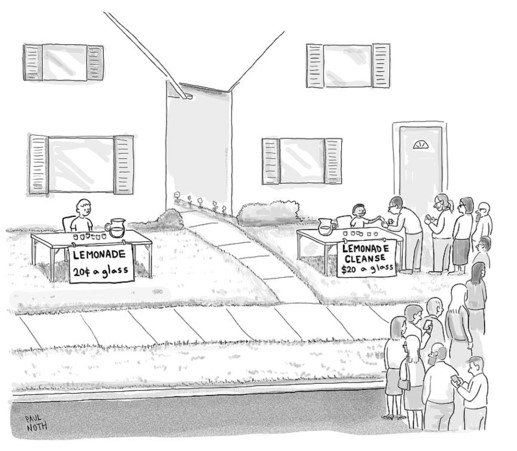

Step 2: Get your customer value proposition right

Your CVP is what really matters to your customers – the value they feel they gain when they purchase your products or services. When the economy turns down, customers tend to re-evaluate the value they’re receiving from what they buy and drop anything they feel isn’t adding enough value.

So now’s the time to re-evaluate your products or services and think about ways to add even more value for your customers. What makes your customers choose you over all the other options out there?

Talk to me

about my free Product/Service CVP Evaluation Report and the many ways I can help you make your CVP even more compelling.

Step 3: Don’t just measure. Manage.

There’s an old saying, attributed to management guru Peter Drucker, that “you can’t manage what you can’t measure”. But there’s another term: “Paralysis by analysis.” Meaning that measurement is not an end in itself and is actually a complete waste of time if 1. You’re not measuring the right things, the things that are important and make a difference in your business, and 2. If you’re not using measurements to actively manage and make a difference in your business.

Do you know what the key drivers – the “right things” - are in your business? Do you monitor them and use them to manage your business in an agile and effective way? Take advantage of my

free Initial Consultation

to talk about your business’s needs.

Step 4: Kick out the constraints

Just as important as discovering and doing the “right thing” is getting rid of the “wrong things”. These are the problems or constraints in your business that hold you back and prevent you from fully achieving your goals. They could be bottlenecks in your manufacturing process, staffing issues, project risk – the list goes on and on. What’s the biggest constraint I’ve found in most businesses? You, the business owner or manager, and the constraints in your thinking about your business. Just saying.

Take advantage of my free Initial Consultation

to talk about my 5-step process for identifying and systematically eliminating constraints from your business. Step 5: Fire non-performing customers

Turn business away? Never! But what about those customers who take up a lot of your people’s time for very little return? Wouldn’t that time be better spent working with more profitable customers and building your base of higher performers?

I found when I first started my consulting business that the first contracts I felt grateful to get soon became constraints on gaining clients whose business I could really add value to. Dumping those contracts felt like a risk, but doing it enabled me to take the business to the next level sooner than I expected.

Do you sometimes take on customers or projects just for cashflow reasons? Do you have high-maintenance, low-value customers who are a drain on your resources?

Talk to me

about a better way to optimise your customer management and bring in more high-value clients.

Step 6: Get flexible

It’s human nature when crisis strikes to stay where you are, to cling to what you’ve got, to freeze. Remember those videos of holidaymakers just standing on the beach in Thailand, transfixed by the sight of the oncoming wall of water just before the tsunami struck? What about the passengers in the Titanic who remained in their cabins rather than race for the lifeboats?

Hope is not a strategy in business. If what you’ve got isn’t working especially well now, clinging to it in a recession isn’t going to work at all. Now's the time to make improvements, innovate and perhaps even pivot completely. And even if your business is working well, this isn't the time for compacency. Your market may change, so you will need to be ready to adapt. Think about worst-case scenarios and start planning for them.

Step 7: Think lean, but not mean

Some would tell you to reduce debt. But the fact is, reducing debt isn’t easy. Yes, you could sell plant and equipment and lease instead. Ford did that prior to the GFC and they were the only US car manufacturer that didn't have to be bailed out by the government. Or you could restructure your debt. One of the positives of a recession – yes, they do exist – is that interest rates tend to drop. But let’s face it, interest rates are already pretty low.

Lean business isn't about saving money by doing nothing or worse, cutting the heart out of your business. Lean business is a way of thinking. It's about taking a hard look at your business and figuring out the most cost-effective ways to deliver value to your customers. That may mean leasing rather than owning non-strategic assets. When it comes to your most valuable asset – your people – it may mean developing greater productivity and capability. Some processes may be able to be automated or outsourced to create greater efficiencies.

Here are some things NOT to do:

- Don’t start shedding staff – that will only put the wind up your other employees and start them looking for more stable employment elsewhere.

- Don’t try to put the squeeze your suppliers – that will only weaken your relationship with them. By all means, sit down and talk about mutually beneficial ways of taking cost out of the supply chain. Or look at other supplier options.

- Don’t drop your prices. It may help you build market share, but at what cost. Instead, look at ways of locking in your existing customers and gaining new customers by adding more value than your competitors (see

Step 2 Get your customer value proposition right ).

Step 8: Don’t stop marketing, just do it better

Step 9: Build your reserves

Step 10: Maintain a fun work environment

Download my free ebook before it’s too late

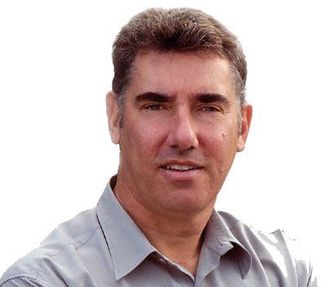

I'm Robin La Pere, no ordinary business consultant. I've been a corporate leader and owned my own businesses, so I understand the impact that recessions can have on businesses which are unprepared.

The experts say the next recession is on its way, so I've taken the initiative of producing an e-book incorporating everything I've learned over the years about getting businesses ready for economic downturns before it's too late.

I've packed

The Ultimate Guide to Business Sur-thrive-al with 45 pages of great case studies of businesses which have not only survived previous recessions, but have actually thrived.

I have also gone into more detail on my exclusive 10-Step Business Sur-thrive-al Programme which would be a valuable guide to building a better business even if there weren't a recession on the way!

Type in your email address here to download your free e-book instantly:

I promise to never share your email address with anyone else

I hope you're getting some value from reading this article. I would appreciate your feedback and would appreciate it if you would email it to me at

robin@noordinary.co.nz.

I'm about to throw you a life preserver.The question is: What will you do with it?

Keep reading, but to find out what's likely to cause the next recession and what preventative action you'll need to take to protect yourself, don't forget to download my free ebook The Ultimate Guide to Business Sur-thrive-al.

It’s coming...

Take action now to protect yourself and your business!

Find out the what, why and when of recessions and what you can do to get ready. Get your free ebook before it's too late!

Type in your email address here to download your free e-book instantly:

I promise to never share your email address with anyone else